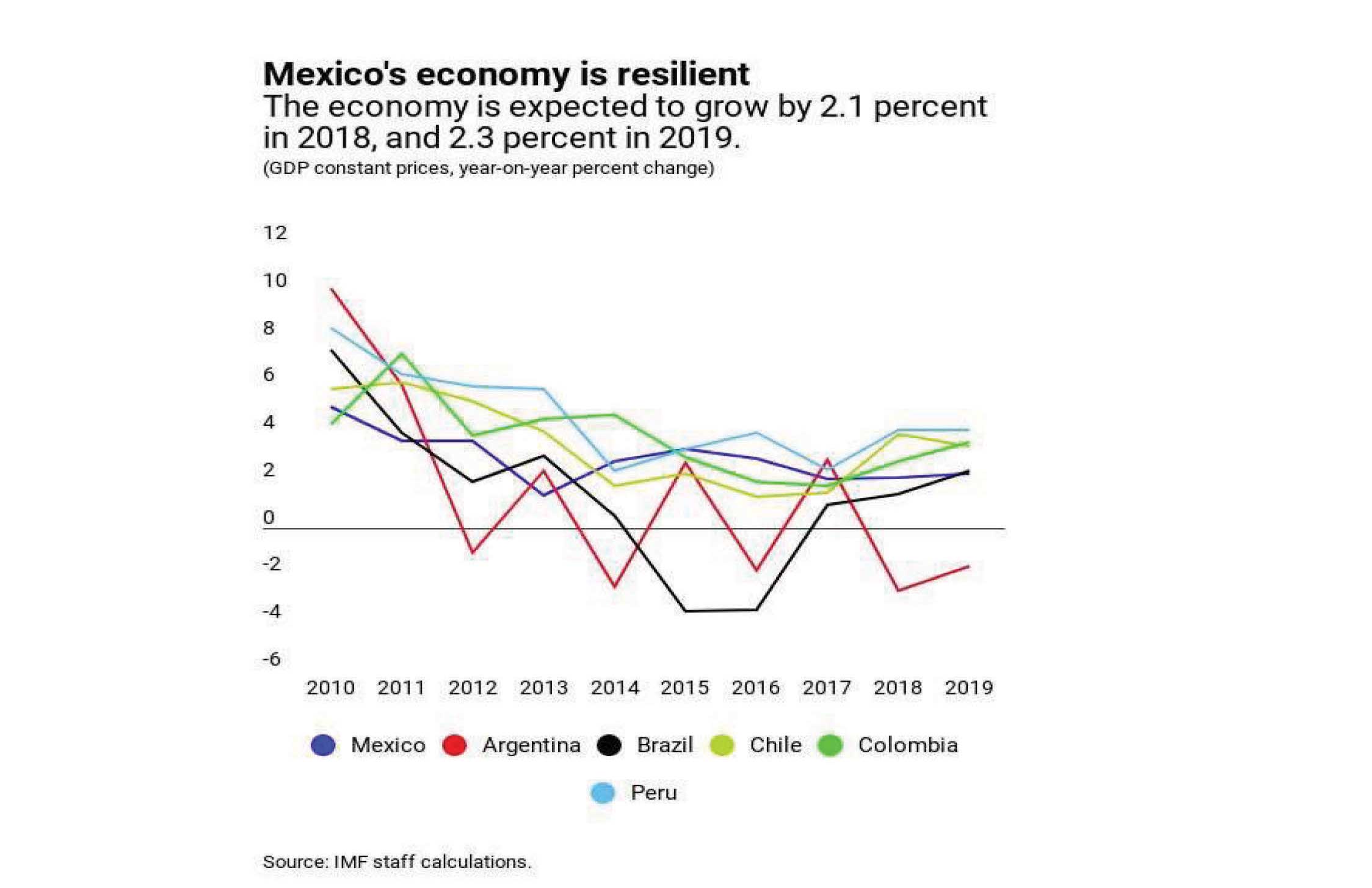

Mexico’s economy continued to grow despite uncertainty linked to the recent elections and the country’s future trade relationship with the United States. In the near term, growth is expected to moderately pick up to 2.1 percent this year and 2.3 percent in 2019. Growth will benefit from strong economic activity in the United States in both years. But continued tight monetary policy and uncertainty related to both the incoming administration’s policies and trade relations with the US will continue, thus dampening growth.

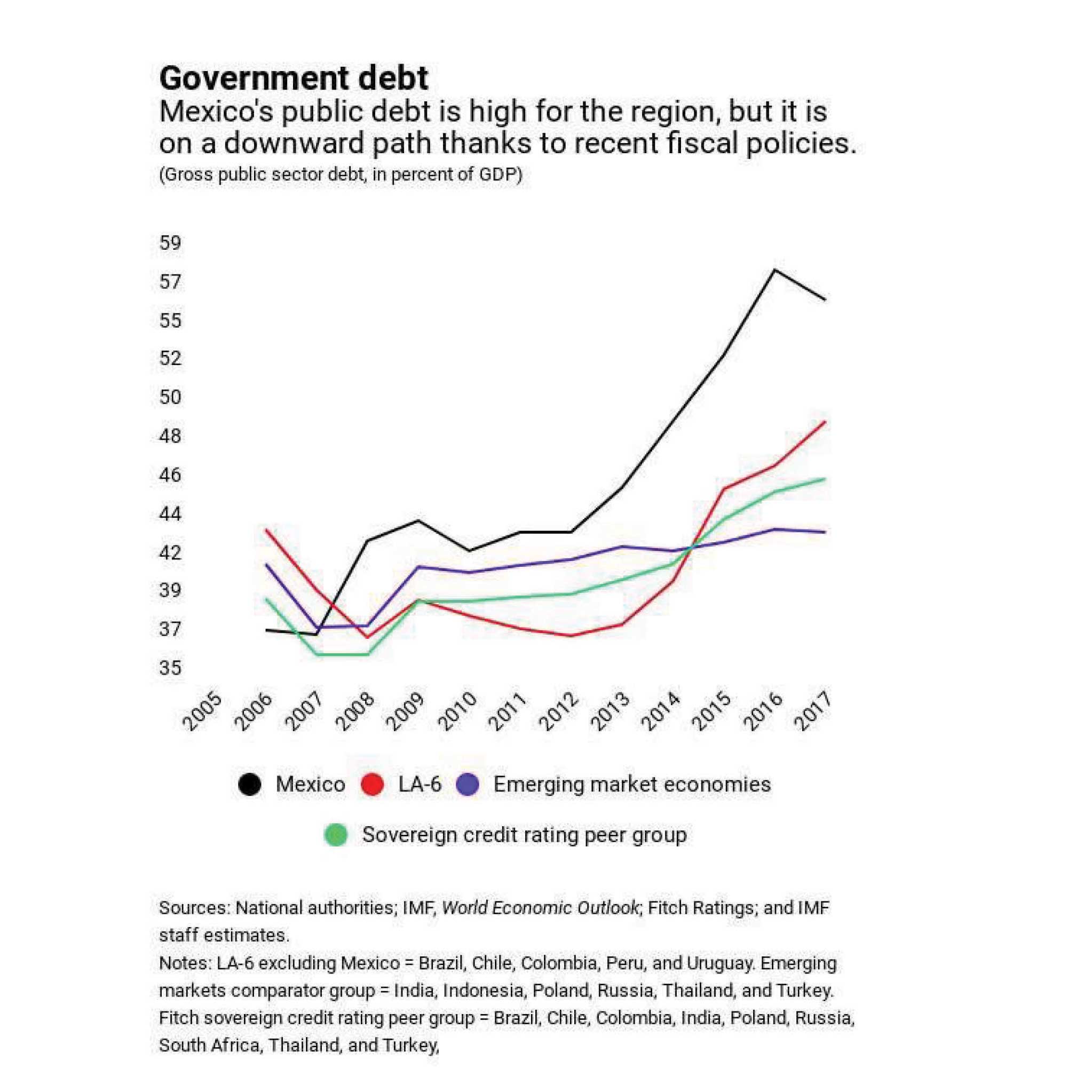

While Mexico’s public debt is projected to stabilize, the current level—at 54 percent of GDP—limits space for social and infrastructure spending. Keeping the overall fiscal deficit at 2.5 percent of GDP over the medium term would stabilize debt at around the current level, assuming that medium-term growth increases to around 3 percent and the interest rate path remains steady..

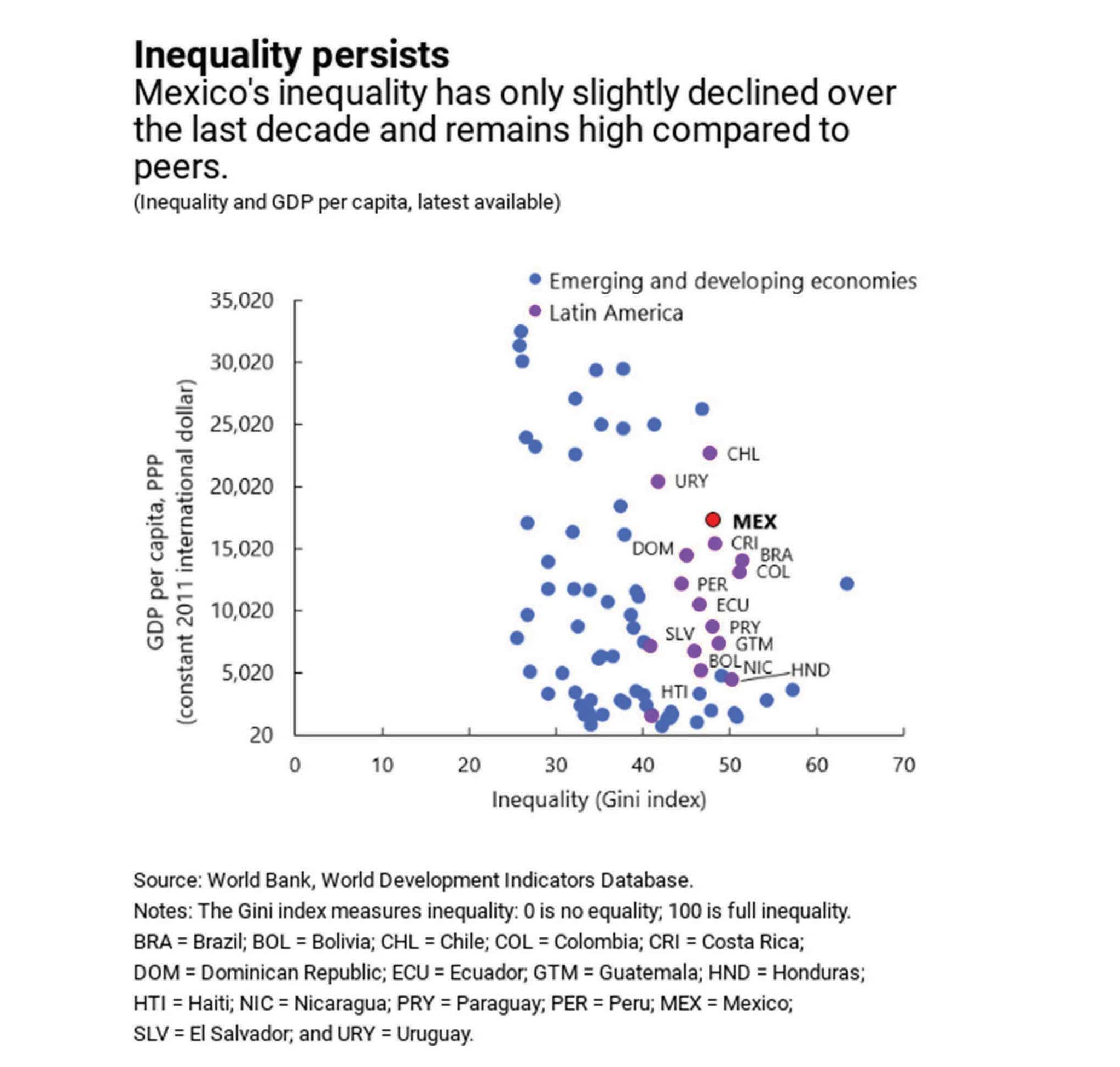

Poverty, at over 43 percent of the population, and inequality at a Gini Index of almost 50, remain high in Mexico. One reason why poverty rates remain high is Mexico’s meager per capita growth in recent decades. Another is that social policies have not been targeted as well as they could have been.

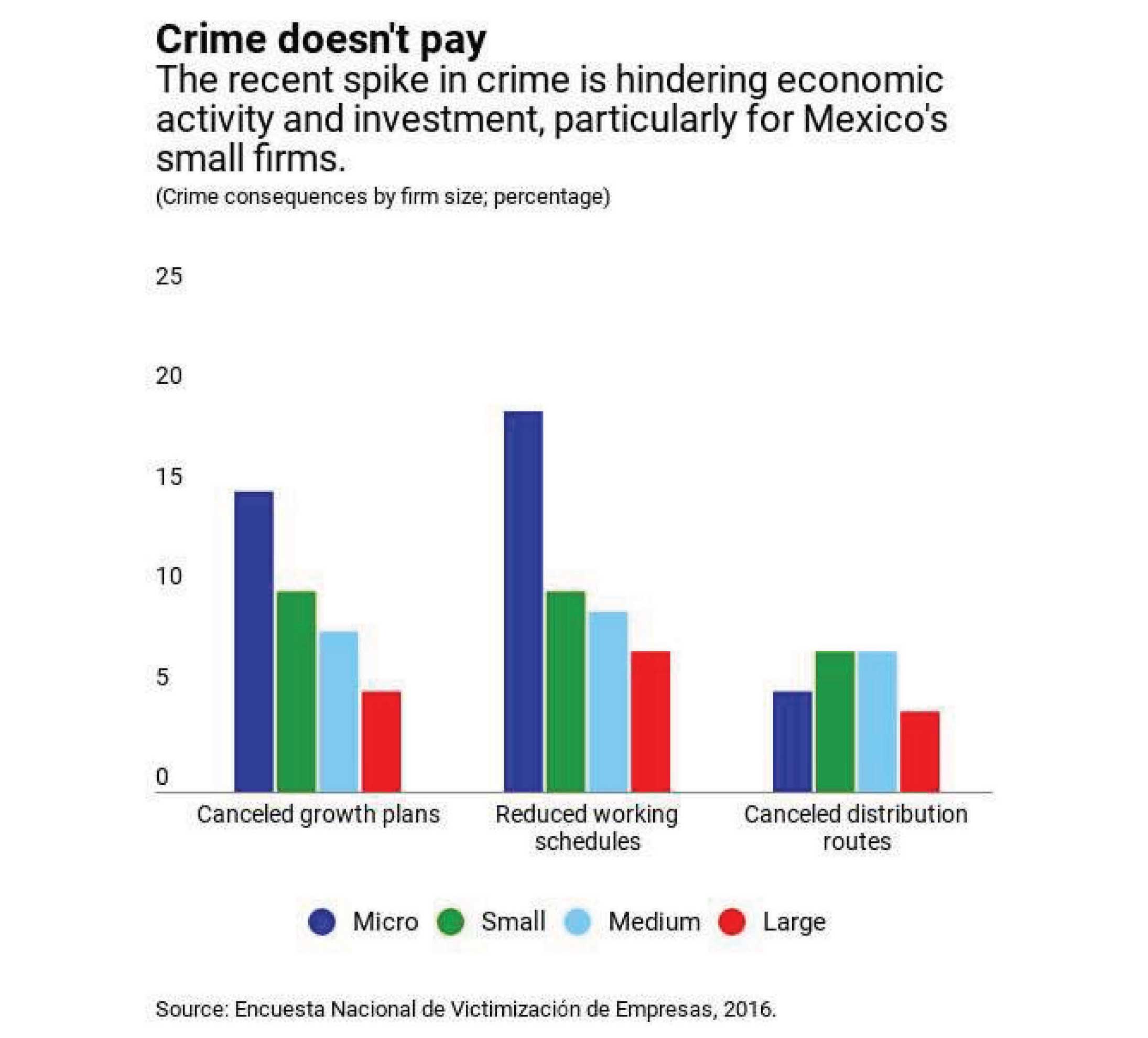

Improving security and strengthening the rule of law is critical to reducing crime and promoting economic activity.

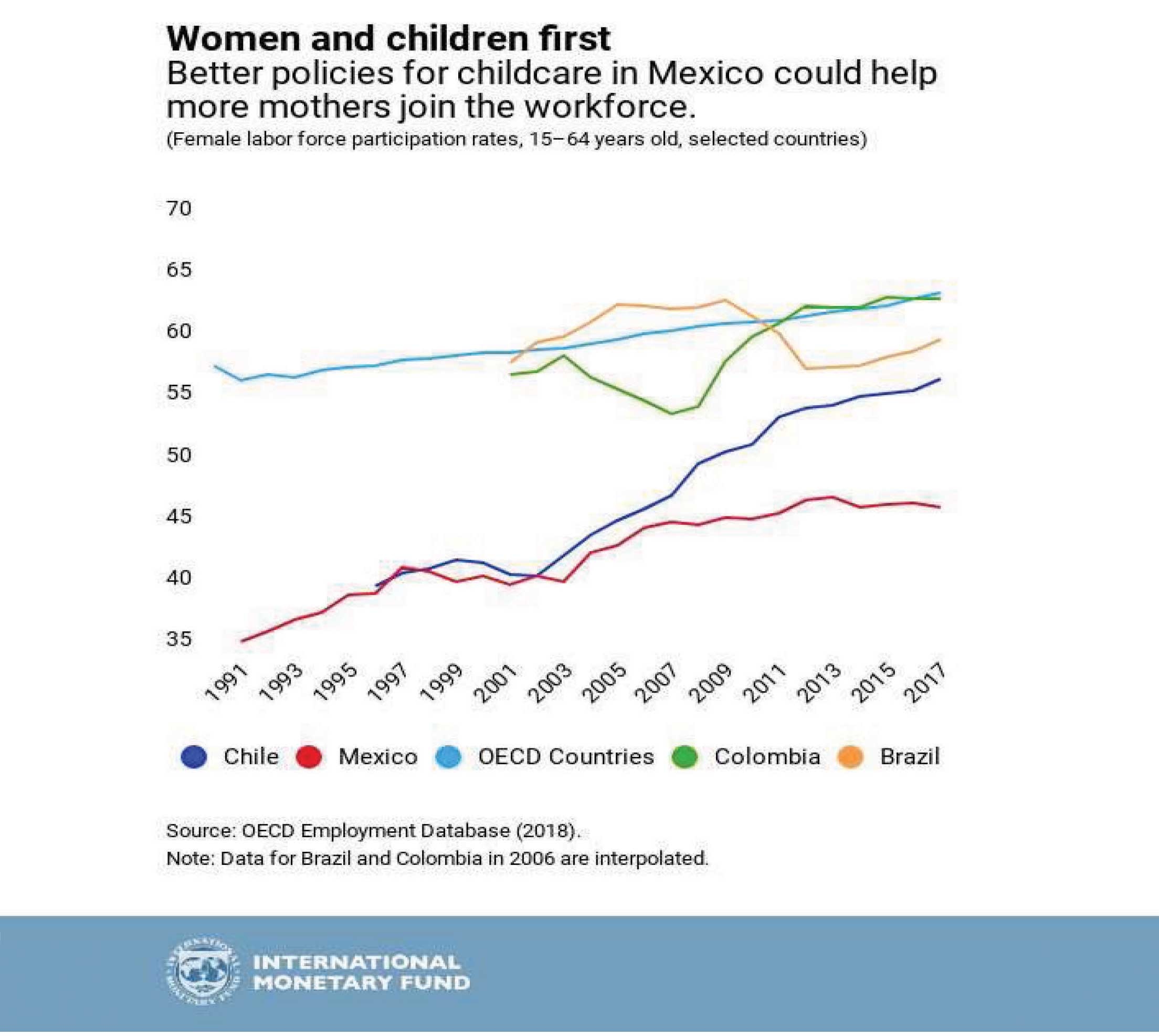

Mexico should continue to support women joining the workforce. Despite significant improvements in female labor market participation and pay equality, women remain heavily underrepresented in the Mexican economy.

* https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD?ye ar=2019

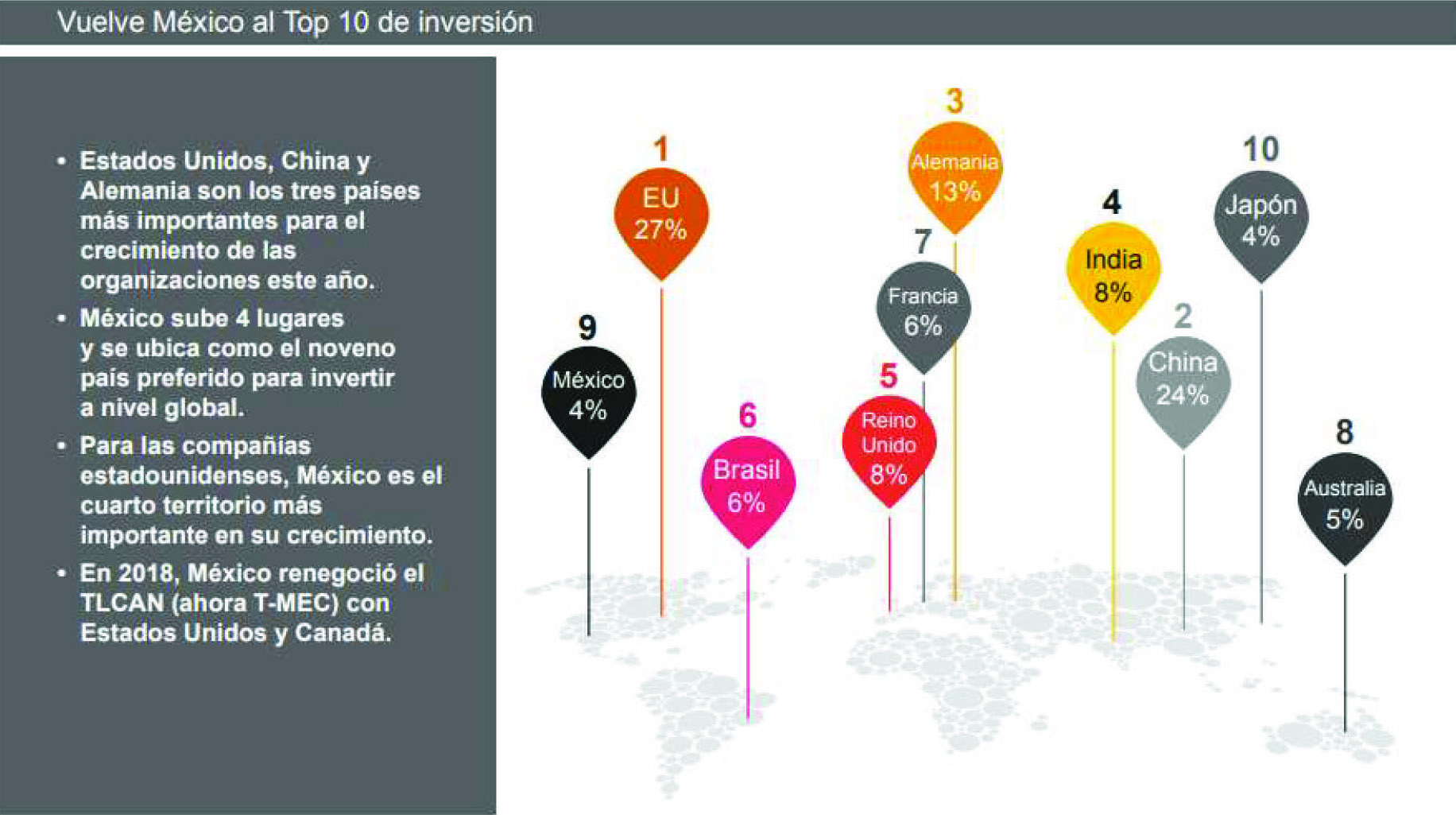

Mexiko ist das neunt attraktivste Reiseziel für ausländische Investoren. Das Land gehört zusammen mit anderen aufstrebenden Volkswirtschaften wie Indien und Brasilien zu den 10 wichtigsten Zielen für CEOs multinationaler Unternehmen, sagte eine jährlich von PwC durchgeführte Umfrage unter mehr als 1.300 Führungskräften aus 91 Ländern. Mexiko kletterte innerhalb von 12 Monaten um vier Positionen: In der Umfrage des Vorjahres war es auf Rang 13 gelandet. Nach Ansicht von PwC ist der Fortschritt eine Folge des Optimismus, dass das Handelsabkommen zwischen Mexiko, den Vereinigten Staaten und Kanada. Auf der anderen Seite erreicht das Land aufgrund von Faktoren wie Korruption und Unsicherheit keine bessere Position.

* http://pwc.com/mx/ceosurvey2019

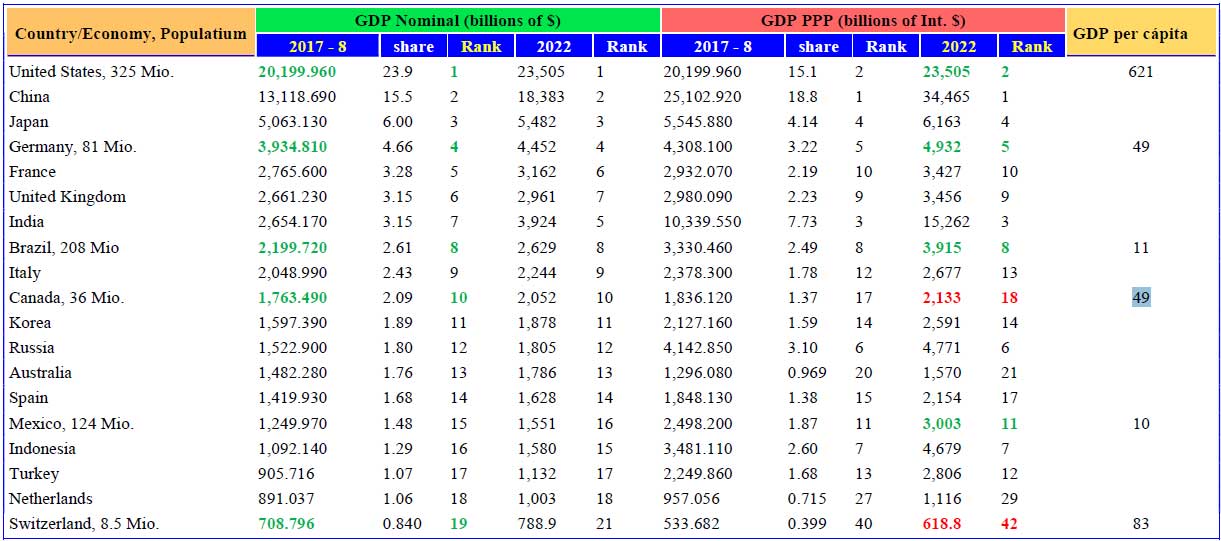

The figure “per capita” explains why Mexico, cannot have the same salary level as in Germany or USA, but most likely like in Brazil. Mexico will have a very strong growth, and the salaries will catch up little by little. Sure, this only works out if the political situation will remain stable. Not like in Venezuela. Mexico will reach place number 7 until 2050, just behind Germany and Japan. Indonesia will reach place number 5!! Chine will be number 1 after 2030. Conclusion, it makes really sense to invest in Mexico, if the political situation remains stable, but this is a small risk to take.

* http://statisticstimes.com/economy/countries-by-projected-gdp.php